Going South

It’s hard to believe that half of the year has almost passed and we’re now looking forward to Spring and longer, sunny days.

It’s as good a time as any to take stock of the past six months.

Needless to say – given what we do for a living – Sydney’s property market has been the centre of our social conversations and I have to say folks, it’s not pretty. The Sydney property market, after years of seemingly endless growth, has hit the wall. The tell-tale signs were there in late 2017 but the beginning of the New Year left no-one in doubt: we were heading south, fast.

If you read our blog, you’ll know that in late 2017, we took a well-earned holiday. We jumped on that plane and headed to Europe confident that while the market could be better, we’d seen worse.

Our first call on returning home was from one of the Inner West’s most respected agents. “Have you heard the news?”

We’d not yet unpacked. No, we said, what news?

“The market has gone off a cliff.”

An exaggeration, surely; after all, we’d only been away for ten days …

Come Monday, we discovered that enquiries had all but dried up and at the first viewings for our new listings the following Saturday, we averaged four buyers for every property.

And so it continued.

In fact, the cliff was so sudden and precipitous that pundits and professionals are still gasping.

So, what went wrong? Here’s our take on Sydney’s property problems.

Big fish, small pond

For many years Australia’s big four banks were happy to lend in the Sydney property market. It was the Season of Profit with forecasts of endless sunshine. Banks and mortgage brokers were happy to lay out a beach towel and relax, knowing that it was nigh on impossible to lose money.

Here’s why. If, for example, a young couple bought a property for $1 million dollars, they could bank on their property increasing in value by about $2,000 a week.

Think about that for a moment…

…in many circumstances, that was a couple’s combined income being matched by property appreciation on a weekly basis.

As the good times rolled on, the banks became less and less concerned, often happy to look favourably on loans that would not have passed the pub test.

Predictably enough, the government finally decided to put the brakes on, and their first target was foreign investors. Foreign money had been flooding the market for a long time, most of it from cashed-up Chinese investors keen for a sunny safe haven for their dollars.

Following the 2017-2018 budget, the Foreign Investment Review Board made the following changes:

- A 50% cap on the total amount of dwellings a developer can sell to foreign persons

- Application fees for foreign purchases of residential property less than $10 million to increase by 10%

- A vacancy charge to be levied on new foreign owners of residential property if the property is not leased or available to lease for at least six months of the year.

To cap it off, the Chinese Government imposed restrictions on Chinese nationals purchasing overseas property.

Suddenly, the big fish left the pond and the effect was immediate.

With the major player in the investment property market removed, remaining buyers saw competitive bidding at auctions dry up.

Add a Banking Royal Commission that shone a light on some truly awful banking practices and before you could slip-slop-slap, the towels were rolled up and the beach deserted.

The disappearing developer

When we think developers, most of us think high rise towers and hulking cranes but there is another player in this eco-system: the small time developer.

These brave souls are not out to make millions but take a calculated risk for a 20% return. Their usual bread-and-butter is an existing old home on a large block that can be knocked down and redeveloped into two or three attached homes or, if the zoning permits, a small block of units or modest townhouse development.

Small-to-medium sized developers are among those hit hardest by changes in bank and Government policy.

Most were well into their developments both structurally and financially when the changes hit.

They saw their 20% return dwindling by the day as the market continued further south.

In a lot of cases, when they sought further finance to finish their projects, the banks simply refused.

Take a look out your car window next time you drive around and you’ll see countless small projects choking with weeds, chained and locked up. Without further finance they can’t be completed and these developers are no longer active in the market.

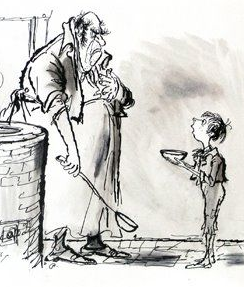

Great Expectations

Of course, the last person who wants to acknowledge this change are the sellers.

In many cases, I can sympathise but let’s be honest, the signs were there – it was the speed of change that came as a surprise.

When the money-tide receded, it left a lot of real estate agents stranded. Frankly, there is not enough business to go around which, unfortunately, leads to unscrupulous agents promising sellers unrealistic prices just to secure the business.

Even after six months, too many sellers are still receiving the wrong advice and these properties inevitably fail to sell.

Smart sellers are not seduced by this practice because they’ve done their research. Our assessment is that property prices have contracted about 5% in the past six months and we always factor this in when appraising property. If all sellers received fair and honest information from agents, vendor expectations would adjust much more quickly and clearance rates would show improvement.

Educated Buyers

In this market, agents underestimate buyers at their peril: they’ve endured years of pain on the property rollercoaster, they’ve saved hard and made great sacrifices for the Great Aussie Dream.

They’re at the bottom of the cliff looking up – and waiting. Can you blame them? In those “good old days” mourned by sellers, so many families experienced bitter disappointment, missing out on their dream home again and again. The experience has left them hardened – they’re not going to let emotion cloud their judgement.

You could say that buyers have switched from a fear of ‘losing out’, to a fear of paying too much and they’re ready to play hardball.

We recently conducted an auction for a lovely two bedroom apartment at 1/162 New Canterbury Road Petersham which attracted one registered bidder.

We had guided this property at $900,000 throughout the campaign and yet on auction day, this buyer would only offer $820,000.

As seasoned agents (who don’t sell bargains) we halted any further negotiations and immediately placed a price on the property. (We’re pleased to say that within days the apartment was sold for $940,000, but this is a good illustration of how the market has turned around.)

The road ahead

While no-one has a crystal ball, we’re sure that things are not going to change anytime soon.

On one hand, interest rates have remain unchanged for twenty two months and we expect them to remain at historic lows but the market is tired. For the next six months at least, we anticipate auction clearance rates to hover around 50%.

Our word of advice – vendors should not be seduced by slick marketing and improbable promises. This is the time to study sale prices and nothing else.

If vendors do this, and disregard agents’ volume of sales, then better results will follow. Eventually, we’ll begin to see new growth.

At Planet Properties, we’re one of a handful of agents to have retained a 100% clearance rate in 2018 so far, for all listings. Experienced agents who have been through this cycle in years past continue to make solid sales.

If you would like to learn more about property opportunities in Sydney’s Inner West, feel free to call us or register your interest in our regular property updates by following the link below.

Sound Advice Rosalie and Mark. You make a lot of sense.